- You get 2 free track lays.

- If the token was in a lucrative spot, it might liquidate for over $0 netting you some cash.

Money movement in 1817

January 8, 2020

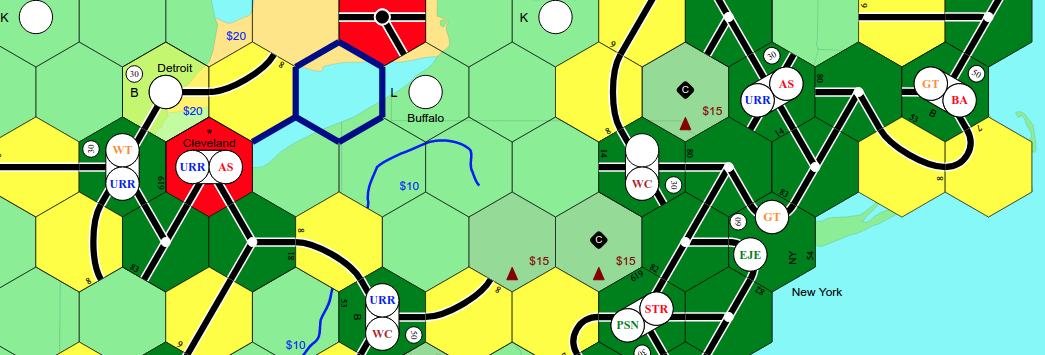

This is a follow on to the previous article about 1817, a strategic economic engine board-game set in the eastern United States featuring track building to accrue money. In this article we will look at the movement of money from a players hands into the company and from the company back to the player.

Player to company

One of the most basic methods of transferring money from player hands into a company is by way of stock purchases. In 1817, 2-share companies are fully funded by default and the 5 & 10 share companies can be bought up to 60% by the president. This means that a president can only purchase 1 more share of his 5-share company. However, interestingly 1817 allows a president to buy upto the maximum when up-converting from a 2-share to a 5-share or from a 5-share to a 10-share. This can potentially by a very good source of income especially in the first MA round.

A second very interesting way of transferring cash to a company is to start another company at a high par value (being the first person to float a company at $200 par ensures that it will go first as long as there are no other companies with a higher par which could not be shorted to fall under the $200 mark), and then purchasing an about to rust train (likely a 2T) from one of your weaker companies thereby injecting tons of cash into it. Once the train rusts, simply let the newly started company liquidate. The advantages of doing this are two-fold:

Company to player

Again, one of the more typical ways that companies transfer money to players is simply by running trains and paying out. However, a friendly sale is another incredible tool which allows one to get rid of a non-performing company and redeem cash in order to be able to do something better with it.

A friendly sale is typically useful when you have a company with a high stock value but not a very great route and perhaps a few loans which will likely make it a very juicy short candidate in the upcoming Stock Round. One strategy in this scenario is to let one of your lower valued companies buy out the trains from the high value company and then put the high value short candidate up for a friendly sale. If the company has over $100 in stock value (perhaps as a result of a merger of 2 non-performing 2-share companies), no trains, a few loans and a sales tag of over $500, then you are pretty much guaranteed to be the only bidder. Ensuring the sale itself will require some math and you need to prepare one of your companies to be able to afford it. This can be done either by up-converting it to a 10-share or simply withholding in order to take on the upcoming sale. When done right before SR3 when the 4Ts are looking to come out, it can be a very effective strategy to deny the others any short selling opportunity and provides you with some decent cash which can be re-invested into the surviving company (see previous section).

Note that for any company sale it might be possible for the buying company to take on more loans that it is legally entitled to as long as it can redeem enough loans to end up with the maximum legal loan limit:

Money re-cycling

An astute reader might be able to combine the points above and see that one can actually simply recycle money by starting a company, buying a train, running it once and have and older company withhold and buy the train off of it in the second operating round and acquiring the company by way of a friendly sale right before the Stock round. Repeat ad infinitum until the older company gets a permanent train and after which one could simply merge the older company up to increase stock value and start paying out.

The reason for doing this is that it keeps the original company's stock value low enough that it is not a viable short candidate and more importantly it provides valuable liquidity when heading into a stock round! One is therefore able to start companies in preferential locations and/or short others without the risk of being shorted themselves. However, do note that this is very difficult to execute as it is very likely that the shell company will get sold out quickly leaving you stuck with 3 non-paying shares. Moreover you need to ensure that the shell company has a great route with which it can generate enough income to afford the friendly sales without taking on extreme amounts of debt.

This concludes the guide on money movement. The next article takes these concepts and illustrates some advanced strategies that I have successfully seen employed out in the wild.